13. What We're Looking For

Investment

Valu is actively seeking qualified sophisticated investors to help catalyze the next phase of its growth: a $100 million SAFC raise designed to bootstrap a “fractional reserve” or “treasury” in order to create a User Owned (Decentralized and Self Sovereign) Network economy. We are engaging with crypto-native investors, particularly those who share our vision for network-driven value creation, privacy, and programmable trust. Investment allocations are expected to range between $1 million and $10 million.

But we’re not only looking for capital. We are equally committed to engaging with developers, builders, and pre-existing communities— existing communities like sports clubs, unions and religious networks to brand ecosystems—who want to help spread the word, build on the protocol, and co-create economic value within the ecosystem.

The capital raised will fund the coin launch, provide liquidity, and create a diversified treasury backed by Bitcoin, Verus (VRSC), Valu, and fiat currencies. Using Verus Protocol’s basket mechanics, this treasury is designed to deliver asymmetric upside - by enabling fractional or full reserve configurations and auto-arbitrage mechanisms.

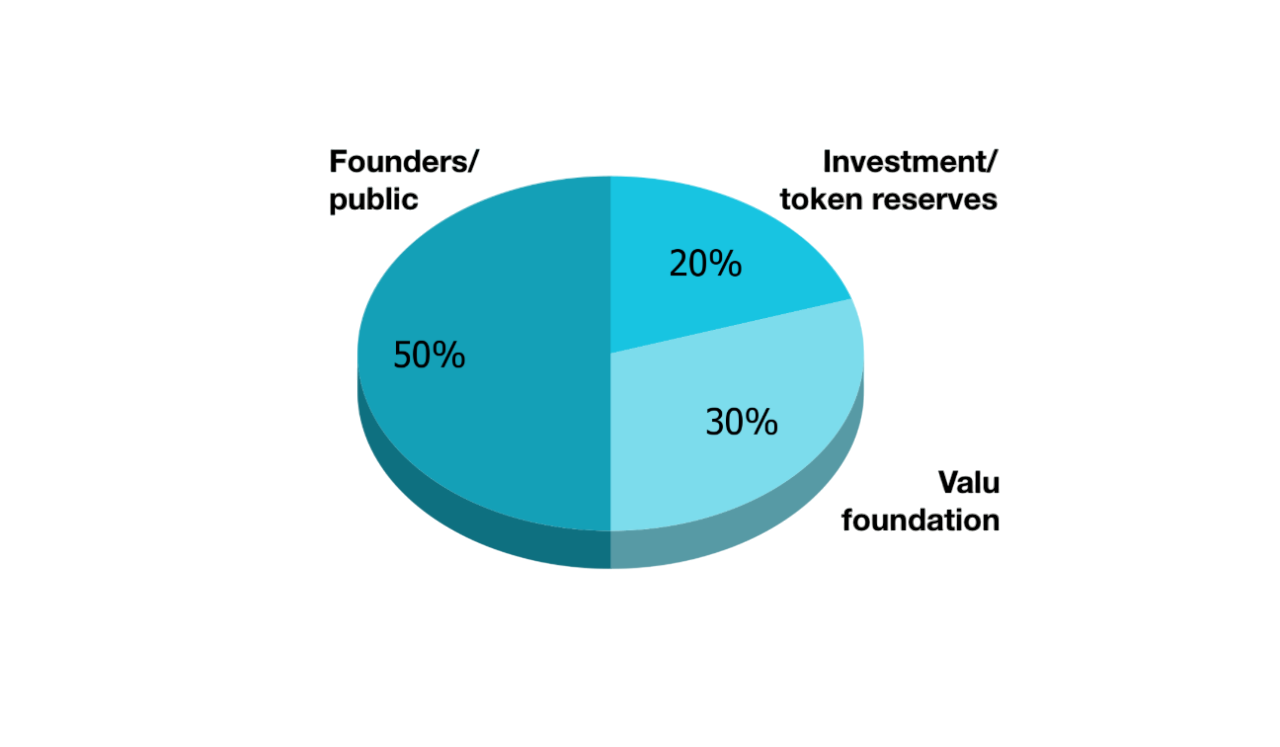

$VALU Coin launch

Following the $VALU coin launch, holders are subject to a structured five-year vesting schedule, enabling the release of up to 20% of holdings annually starting one year post-launch. This framework is designed to promote long-term alignment and network stability. Additionally, vesting can accelerate dynamically based on predefined trading volume and market capitalization thresholds. To complement this, a $250 million trade-weighted liquidity facility is in place, providing qualified counterparties with secondary market access from day one.

Governance & Sustainability

Proceeds support a transition to a Swiss Foundation, which will hold core IP and oversee the application layer. The foundation will act as a public-good steward, moving toward decentralized governance by coin holders over time.

The strategy is designed to bootstrap the network flywheel, aligning coin economics, user growth, and ecosystem incentives to accelerate long-term value creation.

Capital Deployment Strategy

Product Development

- Extend and refine the Valu App, Valu Wallet, Valu ID, ValuVerse (3D gamified spaces), Valu Guru (AI), and Valu Social

- Integrate AI tools like OpenAI, Llama and bespoke LLM's to automate user opportunities

- Launch digital product passports to embed provenance and interactivity in branded goods

Community Growth

- Onboard affinity and affiliate networks (e.g., ATU 1181, religious groups, brand communities)

- Launch data unions for collective, privacy-protected data monetization

- Use paid messaging to drive direct engagement and rewards from brands to users

- Position Valu Social as a secure, community coordination tool (a Web3-native WhatsApp)

Sales & Brand Partnerships

- Build teams to help brands launch their own currencies, metaverses, and data monetization tools

- Leverage relationships with 135+ Fortune 500 brands already onboarded through prior webkey (see Valu Key) campaigns

- Provide the “onramp for Advertisers, Financiers & Corporations” into the Internet of Value

4. Ecosystem Expansion

- Support a global, open marketplace for entrepreneurs and creators

- Enable development of mini-apps and storefronts within Valu’s ecosystem

- Integrate gamified multi-verses for immersive user interfaces and experiences