1. The State of the Economy, and How to Redress the Balance

Why the Economy Feels Broken

80% of U.S. households live paycheck to paycheck. That’s the trauma loop.

When you’re always under pressure, you don’t have time to think ahead. You’re stuck solving today, not building tomorrow. That stress keeps you from growing, from planning, from owning your future.

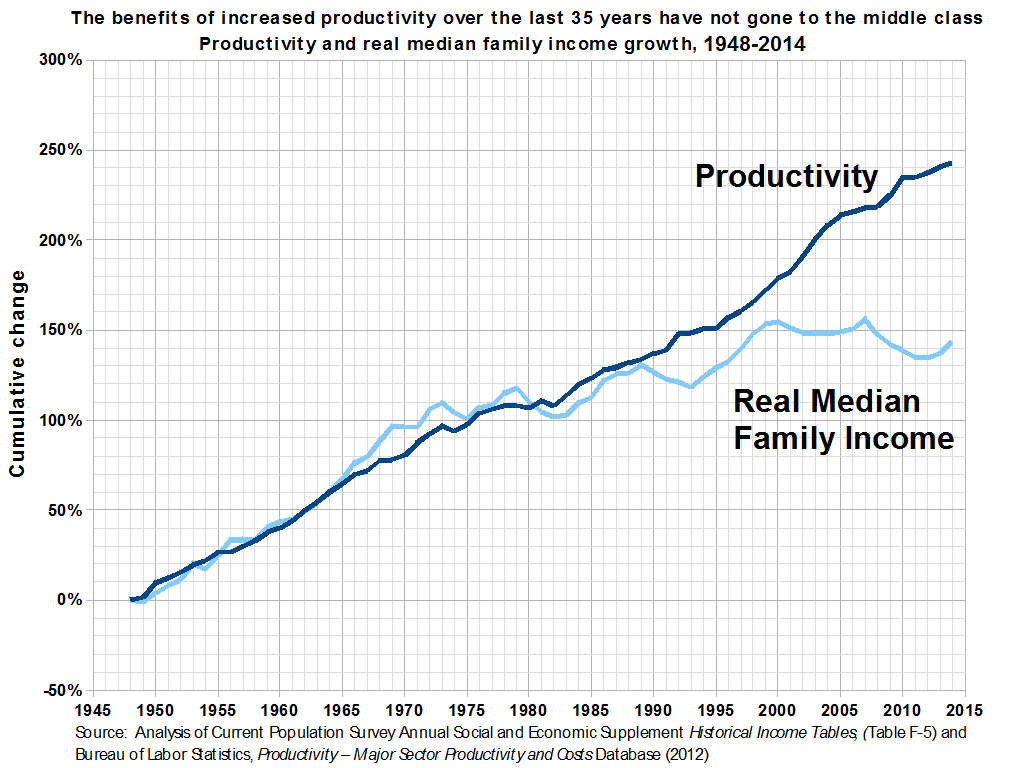

Real median household income has flat‑lined for two decades while corporate profits and productivity have surged.

We've all seen this graph:

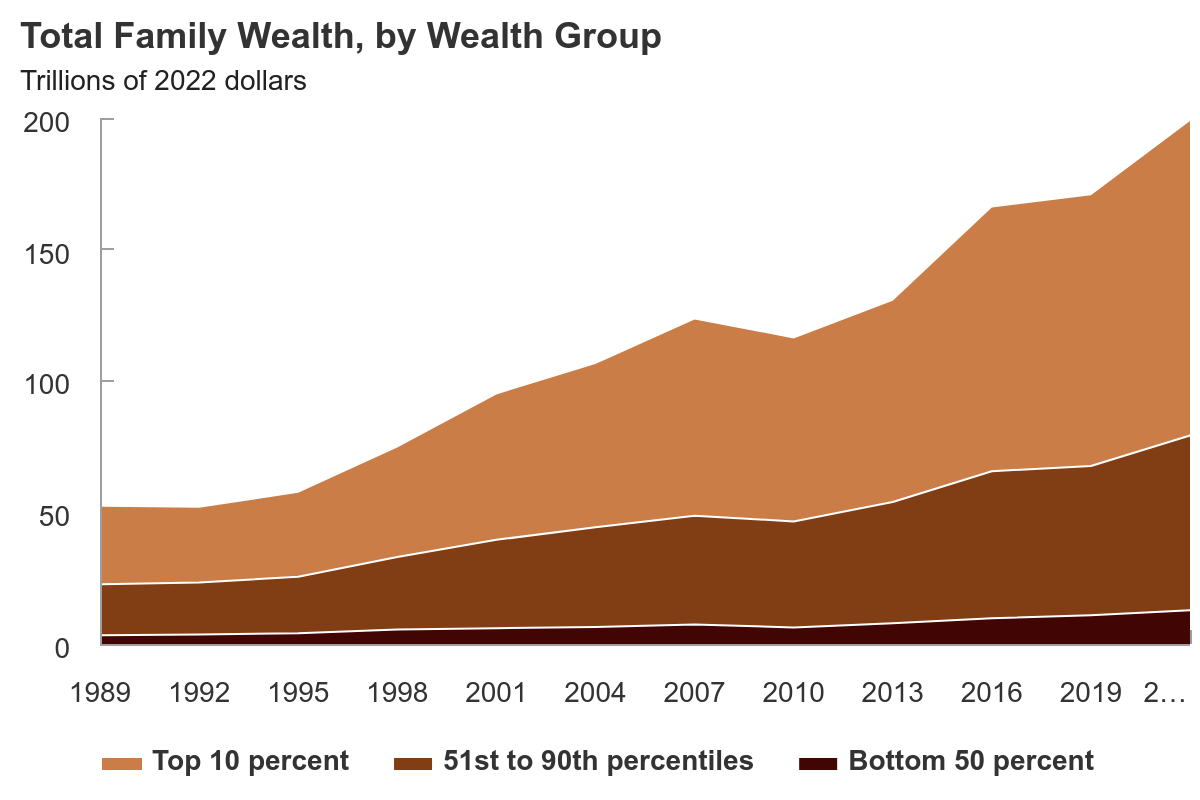

...yet if A.I. delivers anywhere close to the productivity gains over the next 10 years that some analysts are predicting it's likely the middle class in this very brown chart could vanish down into a new, barely perceptible black line right at the very bottom:

40% of U.S. Households don't hold any stock either directly or indirectly, so that roughly checks out with how badly the bottom 50% have been doing in the last 30 years. This point is driven home further when you realise that the Top 10% now own 93% of all U.S. stocks, a record high.

Where the money is being spent

The median U.S. household earns around $80,000 pre-tax and nets $56,000 after taxes. Roughly 80% of Americans spend nearly all of their net income, with only ~3.6% saved. The average household also carries $7,000 in revolving credit card debt at ~22% APR, plus car and mortgage loans at ~8% and 7%, respectively.

If we treat the entire $56,000 of household spending as flowing to businesses (big or small), and use the S&P 500’s average net margin of 12.5% as a proxy for overall business profitability, then U.S. businesses capture about $7,000 per household per year in net profit.

If we further assume that businesses spend 30% of their net profit on advertising (a reasonable average across S&P sectors), that implies about $2,100 per year per household is spent on advertising just to acquire and retain that household's economic activity.

Who is benefitting

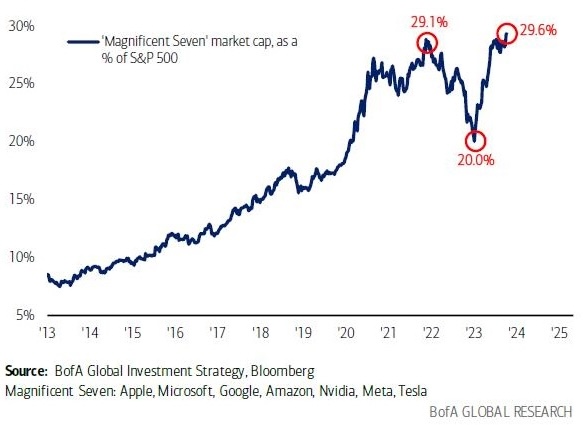

The graph below provides shows the Magnificent 7's share of S&P 500 total market cap over time.

All of these companies are in an arms race for your personal data, they're stockpiling compute power to feed AI ...and they are all in the advertising game in one way or another. 40% of U.S. households may not own any stock, but 92% of U.S adults own a an internet device that the Mag 7 use to harvest data and become trillion dollar companies.

The implication here is that value accrues to platforms that can monetise user data at scale. Without a mechanism for individuals to participate directly in that upside, inequality widens.

Redressing the balance

This presents two clear opportunities to create a more balanced economy for individuals, by enabling them to:

- benefit directly from the monetisation of their data

- capture some of the value currently held in the market cap of the companies doing the monetising

This is our 'flippening', and we believe it's absolutely crucial for humanity in a world that is likely be completely transformed by AI in the next decade.